Paul Samuelson was a renowned economist and author of economic textbooks. He was considered to be one of the foremost minds in the field, and was awarded the Nobel Memorial Prize in Economic Sciences in 1970, and in 1996, the National Medal of Science for his contribution to the field.

He wrote Economics: an Introductory Analysis in 1948, a text which was regularly revised and continued to stay in common use, going through 17 editions.

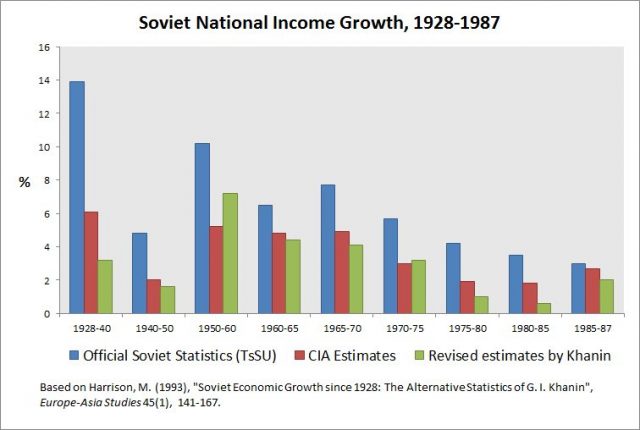

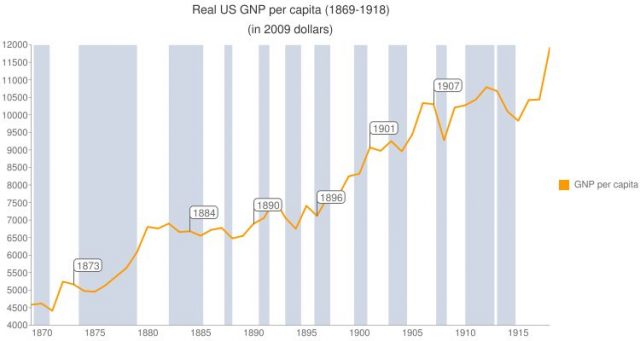

In the 1961, seventh edition of his text, Samuelson noted that, at that time, the U.S.S.R. had a gross national product (GNP) which was approximately half that of the U.S. According to Alex Tabarrok, Samuelson projected that, because of higher levels of investment driving faster economic growth, Soviet GNP would outpace that of the United States, perhaps as soon as 1984, but no later than 1997.

This didn’t happen, and in later editions of the book Samuelson made the same prediction, but pushed back the projected time frames. By the book’s 1980 edition, Samuelson had pushed the date the Soviet economy would overtake the U.S. back to sometime between 2002 and 2012.

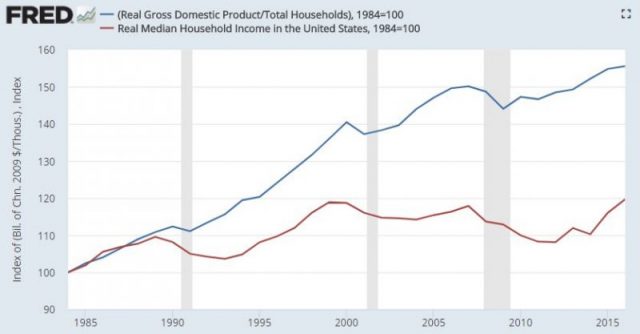

During those same decades, Soviet GNP stayed consistently at about half that of America. Samuelson never satisfactorily addressed this issue, attributing the actual data to issues like “bad weather” and not to how he was making his evaluations.

Authors of other economics texts from the same time projected similar findings through multiple revisions as well. This brings us to the question of how is that multiple experts in the field could be so very wrong?

In Samuelson’s case, some of his pro-Soviet bias may be, in part, a result of his personal beliefs. He was a fan of socialism, and as he said in the 1989 edition of his hallmark text, “The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.”

That can’t be a complete answer to the question, however, as there were other economists and authors whose views were even more leftist, but who made more accurate projections, including Lorie Tarshis and Robert Heilbroner. Other factors were clearly in play.

Michael Hudson says in his article that the field of economics underwent a shift about a century ago, in which it moved away from analysis rooted in the real world, with its many and constantly changing variables, to more “introverted” or theoretical models.

Refreshment In The Workplace (1951)

Current economic thinkers have been ignoring social conditions and the consequences of how people and systems actually behave. According to Levy and Peart in their article Soviet Growth & American Textbooks, this idea is reinforced by noting that among those economic theorists who made more accurate projections, such as Tarshis, they made use of models which relied on data that was based in the real world (“thick models”), as opposed to relying on more purely theoretical models, as Samuelson did (Levy and Peart).

Ignoring the empirical in favor of the theoretical can give wildly inaccurate results, such as Samuelson’s assessment of the Soviet economy. Using a flawed model gives a much better explanation for his miscalculations in his comparison of Soviet-U.S. growth rates than “bad weather.”

One of the biggest problems with using flawed models is that it doesn’t just exist in the classroom. Students leave the classroom and go out into the world to teach, or to shape policy, which is often heavily influenced by those theories and methods taught in school. If those theories don’t reflect the real world, neither will policies and practices which come from them.

There is a branch of the field called social economics, however, which has been gaining ground. Its primary focus is on the relationship between economics and social behavior, and examines how ethics and behavioral norms affect consumer behavior.

Read another story from us: When Forgeries Become Famous: The Shadwell Dock Medallions

Although this is still an offshoot branch of the economics discipline, perhaps it will start moving the field back toward a wider and less academic view, to the positive benefit of our economic practices in the future.