Everyone has an opinion on taxation. Generally, people aren’t too happy about paying taxes, but the fundamental reasoning behind many tax systems is relatively rational; taxes allow societies to progress and evolve, with the funds raised through taxation ideally going towards supporting and developing public services and projects.

The world has seen some very strange taxes over the years, with several odd tax laws still in effect today, but perhaps one of the strangest and most notorious of all was the Window Tax, which was in placed in England and Wales from 1696 all the way through to 1851. For over 150 years, this tax forced property owners to pay tax based on the number of windows in their home.

The idea sounds ludicrous, but it was actually based on quite sound logic. According to British History Online, the tax was introduced in 1696 by King William III.

The idea of the tax was actually similar to a modern day income tax; the King wanted to put a tax system in place that made rich people pay more and gave poorer people less of a financial obligation.

The Window Tax was effectively able to act as an income tax, but disguised as something different. Naturally, wealthier people would have larger houses with more windows, and would therefore have to pay more, while those who were poor would have fewer windows and smaller payments to make.

Nowadays, the idea of income tax is relatively widely accepted, but back then, it was a highly controversial and divisive concept. Many people throughout England and Wales were entirely opposed to the notion of income tax, as they felt that it was a way for the government to interfere in people’s private lives and threaten their freedom.

As reported by The Telegraph, the Window Tax was introduced with a flat rate of two shillings per house — with two shillings being equivalent to around £14 or $18 in today’s money — plus a variable tax dependent on the number of windows in the house.

Only properties with 10 or more windows had to pay the extra fee. Those with 10 to 20 windows would need to pay an additional four shillings in total, while those with more than 20 windows were charged eight shillings.

https://youtu.be/MBP_PpkK9gI

This meant that those living in relatively small or standard homes would only be charged the initial two shillings. In practice the system didn’t work out too well for the poorest people living in large towns or cities. The cheapest lodgings were in tenement blocks, which counted as one dwelling under the tax — so to avoid paying up, many landlords simply bricked up the windows.

Similar taxes were established in France, Scotland and Ireland. Over the years, the system was changed in various ways, eventually reaching a point where the flat rate was upped to three shillings and houses with over 20 windows were charged an additional shilling per window.

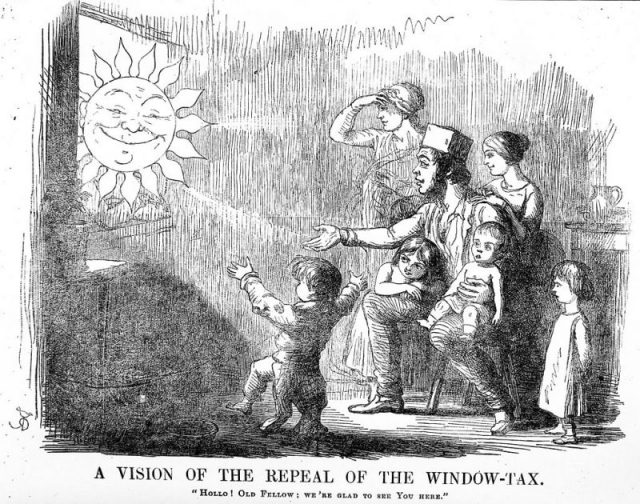

In all of its guises, with all of its varying rules and fees, the Window Tax was always unpopular. Some people, as revealed in documents digitized by the UK National Archives, argued that the tax was forcing people to pay for the alleged privilege of light and air in their own homes. The Window Tax had a real effect on society and the construction of buildings around England and Wales.

New homes constructed during this period were actually designed with the Window Tax in mind, so would often have as few windows as possible in order for the owners to pay the minimal amount of tax. Other property owners actually went as far as boarding and blocking up their own windows, rather than pay the tax.

In the end, after a lot of debate and protest, the Window Tax was repealed on July 24, 1851. It had been in force for a total of 156 years. It was replaced by a more standard form of property tax which people felt more comfortable paying, and allowed many of those old homes with blocked up windows to be restored and given some much needed light and air.