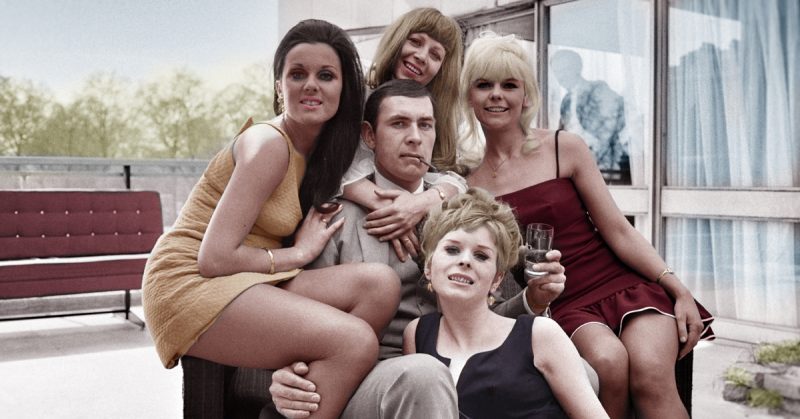

Single, footloose, and fancy-free, the bachelor life is often portrayed as an ideal existence. According to the stereotype, single men have few cares and responsibilities, and, in the absence of a wife or children that require their support, are able to sustain a hedonistic, wild lifestyle.

Yet, throughout history, governments and lawmakers have sought to place limits on the numbers of bachelors within society by using an age-old method: taxation.

For 2,000 years, bachelor taxes have periodically appeared in societies across the world, targeting single, childless men who were thought to be a useful source of revenue.

As far back as ancient Rome, according to Tax Fitness, the idea of specifically taxing single adult men has held a consistent appeal for governments and states looking to raise revenue and control social behavior. In 9 AD, the Roman Emperor Augustus levied the ‘Lex Papia Poppaea’, which imposed a tax on single men and married couples who did not have children.

The purpose of the tax was to encourage marriage and procreation and to prevent immoral behavior. However, it also proved to be an excellent way to raise funds for the state, and has been imitated in societies across the world ever since.

In 1695, when the English Crown was struggling to raise capital for yet another expensive war with France, a bachelor tax was imposed to generate income. This law, known as the Marriage Duty Act, placed a fixed tax on all single men over the age of 25.

Bachelor taxes could also be used to regulate population growth. In South Africa, in 1919, a tax was imposed on bachelors in order to encourage white families to have children, a policy rooted in pre-apartheid racial politics and born out of fears that the white population would soon be eclipsed by the black community.

Similar attempts at social engineering can be found in Mussolini’s Italy. In 1927 he declared a tax on unmarried men as part of a drive to raise capital and to expand the Italian population. His racially driven ideology was bent on making sure that the (in his view) superior Italian race outstripped the rest of Europe in terms of population growth.

In other cases, however, the bachelor tax was more about imposing moral order on society in a time of heightened panic about the hedonistic behavior of young single men.

According to Tax Fitness, in the 19th century, the state of Michigan made repeated attempts to impose a bachelor tax, based in part on the idea that single men were statistically more likely to engage in delinquent behavior than married men.

A similar tax had been introduced in Missouri in 1821, consisting of a fixed $1 annual tax on all unmarried men. However, in Michigan, the proposed ideas met with considerably more resistance. Many men complained that such an initiative was an intolerable form of gender discrimination, questioning why men ought to be singled out for extra taxation and not women.

Despite the controversy, further proposals were put forward in 1837, 1848, 1849 and 1850. More successful initiatives appeared at the end of the 19th century and beginning of the 20th century. The arguments that prevailed during these debates often centered on the behavior of single men, and the perceived need to coax men into marriage.

Opponents of the bill, however, suggested that if the bachelor tax were to stand, then a similar tax needed to be imposed on all women of marriageable age who had refused marriage proposals.

Despite resistance, proponents of the bachelor tax continued to push forward with their agenda. In 1921, in Montana, a $3 tax was successfully imposed on all unmarried bachelors.

In addition to this, in 1934, the state of California proposed a $25 bachelor tax, primarily as a strategy to boost the state’s falling birth rate. However, the proposals were not taken forward and the bill was never actually implemented.

Although the bachelor tax has been the subject of considerable debate and controversy, it failed to achieve success in the United States. It may be that this is because it was not a particularly effective strategy, either for controlling the behavior of young men or for encouraging them into marriage.

Indeed, as one journalist in the Pittsburgh Press noted in 1921, it was inappropriate to bully men into marriage, and any man who could be swayed in such a way “would lack the nerve and stamina necessary to make him a successful husband.”

Despite the best efforts of the state, in early 1920s America it certainly seems to have proven difficult to convince committed bachelors to give up their carefree lives.